This session will explore the core elements of affordable housing finance, designed to benefit both newcomers and seasoned professionals. We’ll focus on the critical role of Low-Income Housing Tax Credits (LIHTC) and tax-exempt bond programs, essential tools for funding affordable housing developments across the nation. Participants will gain practical insights into tax credits and equity, navigating the intricacies of the application and allocation processes, and understanding the regulatory frameworks that drive competitive financing.

For added depth, the discussion will also highlight innovative strategies for filling funding gaps, successful public-private partnerships (P3s), and other creative approaches to advancing affordable housing finance.

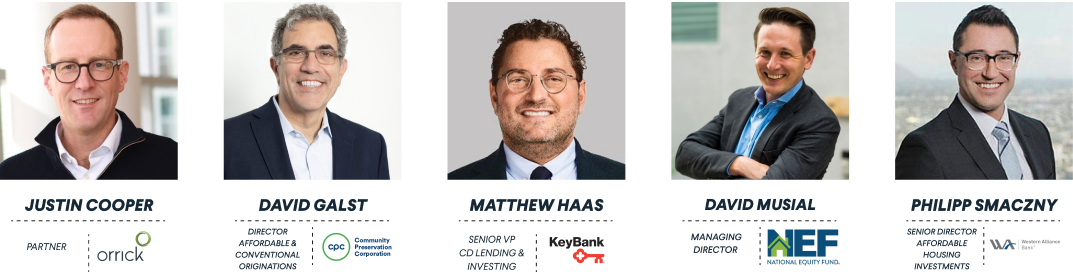

Mastering Affordable Housing Finance: A Comprehensive Discussion on Tax Credits and Bonds